Three months ago I was at my local hotel and noticed a new member of the bar staff. He looked out of place amongst the others behind the bar so I struck up a conversation. Turns out, he used to be a financial analyst with one of Australia’s biggest financial institutions.

These are strange times we live in.

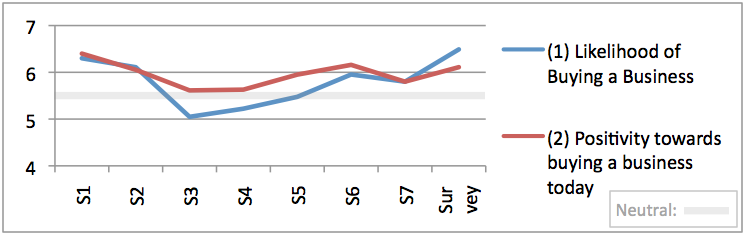

With many major corporations and financial institutions announcing mass layoffs over the past few weeks, a new wave of negativity has been injected into the market. Despite this, recent survey results have actually showed an increase in both a buyer’s likelihood of buying a business (6.9%+) and positivity towards buying a business today (3.1%+)

Given the doom and gloom being reported at the moment, these results may seem incongruous with current events, however they actually tie in quite closely with the motivations that spur business buyers. The motivation for buying a business changes with the economic climate. In positive times the business buyer pool is largely populated with securely employed individuals looking to take a risk by leaving their jobs with the intention of making higher profits than their jobs can provide. In uncertain times however, this motivation couldn’t be farther from their minds.

In September of last year we sold a business to an individual who was leaving their middle management job because they weren’t certain that the job was going to remain secure. This person’s motivations are a perfect example of why many people are buying businesses today: to take control of their financial future and secure their income through investment. With the recent layoffs in middle management, it is expected that this motivation will be the driving force behind many business sales in the months to come.

With this motivation also comes a change in the criteria that most attracts buyers. In times of more certainty, buyers are willing to take more risks in exchange for potential high profits. Though the motivation for high profits still remains, the stability of the business is becoming increasingly more important than it already was for this new pool of buyers. High-profit, high-risk businesses are becoming significantly harder to find buyers for at premium prices, and the reason is this: at the moment buyers are more concerned with financial security than increasing their wealth. It is for this reason that the profit multiplier used to value businesses is dropping.

So how will this affect your business? The more protected your business is, the more likely it is to sell. The factors that are most important to buyers today are as follows-

- Length of operation

- Even spread of suppliers

- Even spread of clients

- Good lease length with options

- Solid and thorough financials

- Limited competition with reasonable barriers to entry

This is not to say that buyers weren’t concerned with these things in the past, but more to say that in the past these factors could be more easily offset by high profits. In contrast, in today’s market they affect the business’s ability to sell or even receive enquiries unless the price is dropped dramatically.

The main point to be taken away from this is that there is a new wave of cautious buyers entering the market. These buyers are in a position where buying a business is increasingly becoming a necessity, but as they are coming from otherwise stable jobs they will be looking for equal stability in their investment. Businesses with higher risk factors will still sell, but it is vital that the risk is offset in the price for which it is marketed. Having more buyers is always a good thing, but the game is changing, and how you play it will determine your success.

By Zoran Sarabaca

Xcllusive Business Sales

Sell your business with Certainty