Before we start, congratulations to our five lucky iPod Shuffle Draw winners- Martin Fernandez, Connie Comber, Tim Sargeant and two others. If you would like to take part in the survey for your chance to win one of five iPod shuffles every month click the link bellow: To take part in the 2012 survey click the link below.

Buyer Confidence Survey

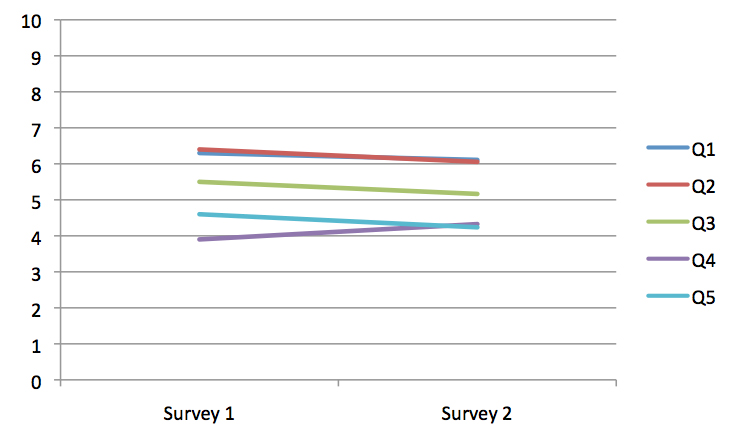

Now that we have two sets of results we can begin to plot how buyers are feeling.

We are more than happy to share this data so let’s take a closer look at what was being asked and the specific results. There were five questions being asked of each entrant. Response was given as a number between one and ten, ‘one’ being a negative response, and ‘ten’ being a positive response.

The questions addressed the following areas:

Question 1: Addresses how likely it is that buyers feel they are going to find a business that suits them in the next six months.

Question 2: Addresses how positive buyers feel about buying a business.

Question 3: Addresses how buyers see the current economic and business climate changing over the next 6 months

Question 4: Addresses how easy buyers feel it would be to finance a business purchase in the current climate

Questions 5: Addresses how buyers feel about the current supply of businesses on the market.

The results are as follows

On almost all topics with the exception of the business finance question (Q4), the results are trending negatively. Though buyers still think it will be difficult to obtain funding (see last Survey Results Blog: The Top 5 Tips to Boost Your Success in Obtaining a Business Loan) it seems that now their major concern is that there are not enough good business for sale, and that they are overpriced.

What’s interesting about this, is that though business buyers don’t think there is a great deal of opportunity at the moment, the survey results also suggest that they are still a surprisingly positive group. Sellers on the other hand are not. More and more frequently sellers are pulling out of sales at the last minute, deciding instead to hold onto the business. So why then, when buyers are so positive, are sellers pulling out at the last minute.

The problem stems from a drop in business valuations. These days, businesses are actually improving, but business values are lower than they were during the Global Financial Crisis.

During the GFC, all business valuations, as they are today, were based on the previous three years trading history, which at the time were solid. What’s happening in 2011, is that in spite of the media reporting that the Australian economy improving, valuations are still based on the previous three years trading history; 2008, 2009 and 2010 – the GFC.

The very nature of how business valuations are conducted means that this drop in business value is largely a three year delayed reaction from a time when business was not so good. Strictly speaking, business valuations aren’t wrong at the moment, but they are certainly less than most business owner’s feel their business is worth and it is because of this, that sellers are pulling out at the end of negotiations.

As an example, let’s say Jeff wants to sell his business. Though he had to tighten his belt during the GFC, his business has otherwise been a successful business. He receives a valuation that is less than he is happy with, but concedes and places his business on the market. After a short while, Jeff enters into price negotiations with a handful of buyers and as you’d expect, the buyers begin to bargain him down. Eventually Jeff manages to agree on a price.

This is where logic kicks in. Jeff realises that based on his businesses current profit trend, he could be making the same amount of money from the business in about two years than if he were to sell it now. He pulls out of the sale and the buyer misses out on a lifetime of profits. So why did Jeff pull out? It simply didn’t make sense to sell the business for that price. Under these circumstances, wouldn’t you have pulled out?

So what can buyers do to avoid spooking their sellers? Remember that a lot of sellers these days have already budged on their desired price before placing their business on the market. Buyers, in an intriguingly strange turn of events, now have to make a business sale worth it for the seller in order to proceed.

In today’s market, a buyer pushing a seller for that extra 10% off the price could mean the difference between loosing sale all together, and gaining a business and it’s future profits that’s already priced cheaper than it should be. It’s a strange turn of events, but for the time being, buyers need to think about the sellers in order to make themselves happy.